By: Don_Miller

I get a lot of questions from readers about holding real estate as an investment. Indeed, many are in response to another newsletter editor who was recently advocating that the only way for retirees to make decent income was to own property.

I get a lot of questions from readers about holding real estate as an investment. Indeed, many are in response to another newsletter editor who was recently advocating that the only way for retirees to make decent income was to own property.

Personally, I wouldn?t hold physical property in our portfolio for three reasons.

First, it?s very illiquid; that makes it an instant failure on our Five-Point Balancing Test.

Second, you won?t get yield from a property for three to five years, but will instead pay to own it.

And third, depending on the size of your portfolio, an investment in physical real estate could throw off your balance. Allocating too much of a portfolio to a single industry is never a good idea. With a piece of property worth $100K, $200K, or more, you can suddenly find your retirement very dependent on the outcome of a single asset class.

However, at the same time, it?s hard to ignore that something is happening in real estate. The post-crash taboo around it is starting to disappear as prices increase. Are we so bullish on real estate that we would buy properties in Las Vegas? No, we?re not there; but at the same time, we wouldn?t mind dipping our toe into the shallow end of the pool with some more conservative opportunities.

Furthermore, rather than invest in physical properties directly, we?d rather invest in real estate investment trusts (REITs), which are traded on stock exchanges like any other stock. REITs are corporations that buy, sell, and rent real estate for their shareholders.

To be considered a REIT, 75% of a corporation?s income must come from real estate in some form. Furthermore, REITs can deduct their dividend payments from taxable income. Here are a few more of their key advantages over physical property:

????????? First, there?s the liquidity. You can buy shares this morning, change your mind, and sell them by the end of the trading day. Try that after signing a purchase agreement and the checks have gone through on physical property.

????????? Second, REITs are required to pay out 90% of their net income to their shareholders or they lose their special tax status. Where physical property doesn?t usually provide yield right away, REITS will start paying right off the bat.

????????? And last, you can invest to match your portfolio, whether that?s purchasing only $1,000 or $1 million worth of shares.

These are some of the advantages of REITs, but there are drawbacks as well. I asked our senior analyst, Vedran Vuk, to find us a REIT worth adding to the portfolio. His pick is a little more conservative than most REITs, but its great way to pick up steady dividend income with capital appreciation potential as well.

As just noted, we?re not looking to dive into the Florida condo market nor to start flipping houses in Vegas. Nonetheless, we still want to dip into the real-estate market... just not in the deep end of the pool.

Healthcare REITs are a more stable area in the real-estate investment world. While they took a hit in 2008 like many other real-estate investments, many bounced back a lot quicker than other REITs. Along with being more defensive, healthcare REITs offer a unique opportunity for retail investors. While most of us could afford a single-unit investment property or even an apartment building, only the wealthiest could even think about investing in a hospital or a retirement home on their own.

While researching the choices in the healthcare sector,

1.??? Opportunistic investing;

2.??? Portfolio diversification;

3.??? Conservative financing.

Opportunistic Investing

Portfolio Diversification

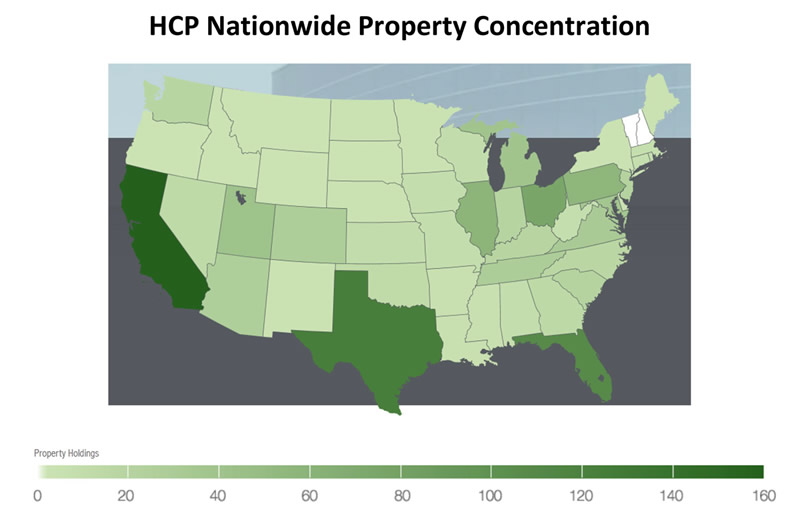

This item is very important to us too. Since this is our entrance into the real-estate sector, we don?t want to put our whole bet on a single part of the country. The map below shows the concentration of properties. While some places like California aren?t our favorite locations, within a diversified portfolio with strong allocations in Texas, Pennsylvania, Ohio, and Florida, among other states, the portfolio is diversified enough to mitigate the risk.

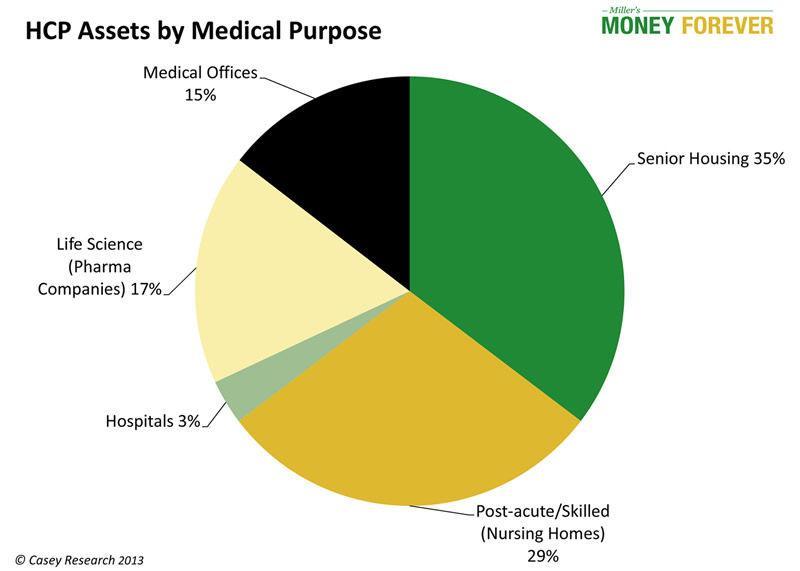

In addition to geographic diversification, we don?t want to get stuck in just one type of property, such as hospitals or medical offices. With more and more healthcare regulation coming through, certain types of buildings will be more affected than others.

For example, for all of the types of healthcare properties, Obamacare will have the most negative impact on nursing homes. The impact isn?t enough to crush those operators, but I certainly wouldn?t want a portfolio of 100% nursing homes in light of the new law. With a diverse mix of properties,

Let?s break down these individual types of properties. ?Post-acute/skilled nursing? facilities are essentially nursing homes with skilled professional nurses assisting residents with continuous therapy.

?Senior housing? includes communities designed to help with the requirements of aging. They are not, however, necessarily staffed with skilled nurses. Senior housing includes assisted-living facilities, independent-living facilities, and continuing-care retirement communities. Some of

?Life sciences? represents office buildings with modifications for pharmaceutical companies and other biotech firms. Currently, almost the entire life-sciences division is located in Mountain View, California (AKA the San Francisco suburbs). However, the company is developing a few new life-sciences projects in Durham, North Carolina.

And last, the ?medical offices? classification is self-explanatory. However, note that these physicians? offices are not scattered around remote shopping centers. Instead, 83% of them are located on hospital campuses. With an almost $21 billion market cap,

Conservative Financing

Perhaps even more important than diversification is the company?s conservative financing. S&P rates

Beyond the credit ratings, a REIT?s loan structure is a key point to take in to consideration, because interest rates are the Achilles heel of the industry. That?s why we?re putting

When interest rates rise, REITs are sometimes squeezed on two or even three fronts. First, with higher interest rates, there will be fewer buyers in the market, meaning real-estate prices will drop. Second, if the REIT wishes to purchase new properties, it will have to pay higher rates to do so. And third, if the REIT was borrowing with variable-rate loans, costs will go up regardless of what happens.

Unfortunately, there?s not much one can do about the first two factors. However, the third can be avoided by staying clear of variable-rate instruments, and that?s exactly what HCP does. 93% of its portfolio is in fixed-rate loans, with only 7% represented by variable rates.

If interest rates rise, does that mean HCP is toast? Not necessarily; REITs are not like bonds. When rates go up, bond prices must go down. On the other hand, higher rates will put pressure on REITs, but will not necessarily crush them. We could have a scenario where there?s a really strong real-estate recovery matched with rising rates ? the surge in demand could possibly offset the higher rates. This is a possibility, but we wouldn?t necessarily bet on it.

When rates start to rise, we?ll likely look for the exit door. Also, be aware of the interest-rate risk in your overall portfolio. If you?re already very heavy in CORP, our PIMCO investment-grade bond fund, consider buying a little less HCP or selling a little CORP prior to adding another asset with interest-rate risk.

Some Other Benefits of HCP

The fact that the medical industry is steadily growing ? in good times and bad ? seems to be the obvious reason for a conservative investment in HCP. But the structure and terms of leased medical properties make them even more secure.

Think about it. Obviously, a hospital or retirement home isn?t going to sign a one-year lease like an apartment tenant. Instead, they often sign for a decade or more. Furthermore, while a tenant in an apartment building expects the landlord to handle most issues, medical buildings are often leased under triple-net leases. In short, a triple-net lease is a landlord?s dream. The tenant pays his rent, along with the property taxes, the insurance, and the maintenance of common areas.

Since the tenant takes care of so much, the actual rent is typically less than in a normal lease agreement. However, this works perfectly for medical REITs, as it takes risk off the table. If a landlord leases a property for over ten years, there?s a significant risk of unexpected costs along the way. In most cases, property taxes and insurance will be more expensive in the future, not less. However, it?s hard to predict how much more. With a triple-net lease, the landlord can enter into long-term contracts without the uncertainty of future costs.

Nearly every single property owned by HCP is leased on a triple-net basis. The only segment excluded from this is the medical-office segment, which has only 48% of properties in triple-net leases. Since these leases take a lot of the risk off long-term contracts, around half of HCP?s leases will expire in 2022 or later. It?s nice to have revenues locked in so far in advance. Below is a chart showing the lease expirations:

??

??

You might be thinking to yourself: ?Wait, aren?t you missing one of your five points: inflation? Isn?t holding a long-term fixed lease a bad thing in the face of inflation??

Of course, that?s right. However, HCP?s leases are written to either adjust to the CPI or sometimes to include a fixed annual increase. Here?s an example of one of its recent contract provisions to protect against inflation:

?The contractual rent will increase annually by the greater of 3.7% on average or CPI over the initial five years, and thereafter by the greater of 3.0% or CPI for the remaining initial term.?

We?ve noted our issues with the CPI before, but nonetheless this is better than nothing. If inflation is tame, real rents will actually increase. If it gets worse, they will at least adjust.

Dividends, Yield, and Pricing

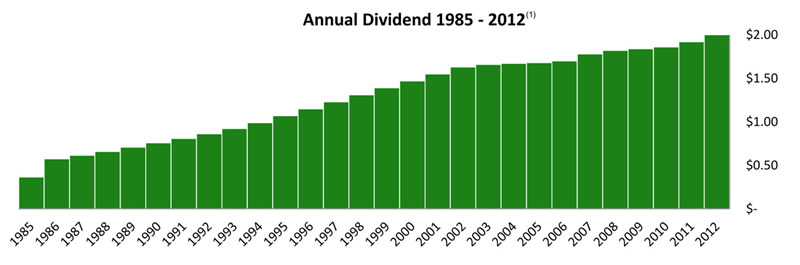

Here?s a pleasant surprise to finish off our analysis. HCP is a member of the S&P 500 Dividend Aristocrats Index. To be part of this Index, a company must have consistently increased dividends for at least 25 years. HCP has done so for 27 and has no plans of stopping now. (Note also that it is the only REIT on the Index.)

As you can see in the chart, the dividend increases aren?t always very large, but they are consistent. Last year, the firm paid out $2.00. In 2013, we wouldn?t be surprised to see around $2.07 per share, which would give us a 4.5% dividend yield.

HCP has been in our portfolio for a few months now, and even before then the company was mentioned in our special report Money Every Month, but we hadn?t officially pulled the trigger at that point.

While we still think the company is a solid pick, there isn?t too much meat on the bone here under current conditions. For the stock to move upward, something new needs to happen, like another push up in the real-estate market. Looking at the trend thus far, there?s a good chance of that happening.

The good news is that the downside isn?t particularly large. The stock could retrace its steps a bit, but I don?t see it dropping 20% overnight. So put in a 20% trailing stop, pick up some regular dividends, and keep an eye on this stock.

If you?re interested in solid, stable dividend stocks then I suggest you check out our recently updated Money Every Month report. You?ll find out how easy it is to get dividend payments every month and I?ll even tell which stocks to start with. Click here to find out more.

? 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

? 2005-2013 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Source: http://www.marketoracle.co.uk/Article40144.html

a.j. jenkins riley reiff david decastro aj jenkins shea mcclellin nfl draft 2012 whitney mercilus

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.